New research explains Asia-Pacific consumers’ new embrace of sustainability in both global and regional contexts.

According to Bain & Company, the world’s awareness of a broadening range of environmental, social, and corporate governance (ESG) challenges is rising rapidly. Nowhere is it growing faster or more dramatically than in the Asia-Pacific region. For example, in Asia-Pacific, 75% of employees now expect their companies to follow sustainable business practices.

But while regulators, investors, and employees are steadily clamouring for change, it is becoming clearer that consumers are a key force in the sustainability movement, which is broadening in scope to encompass a range ESG challenges—everything from product health impacts, to racial equity, to gender rights, to food equality.

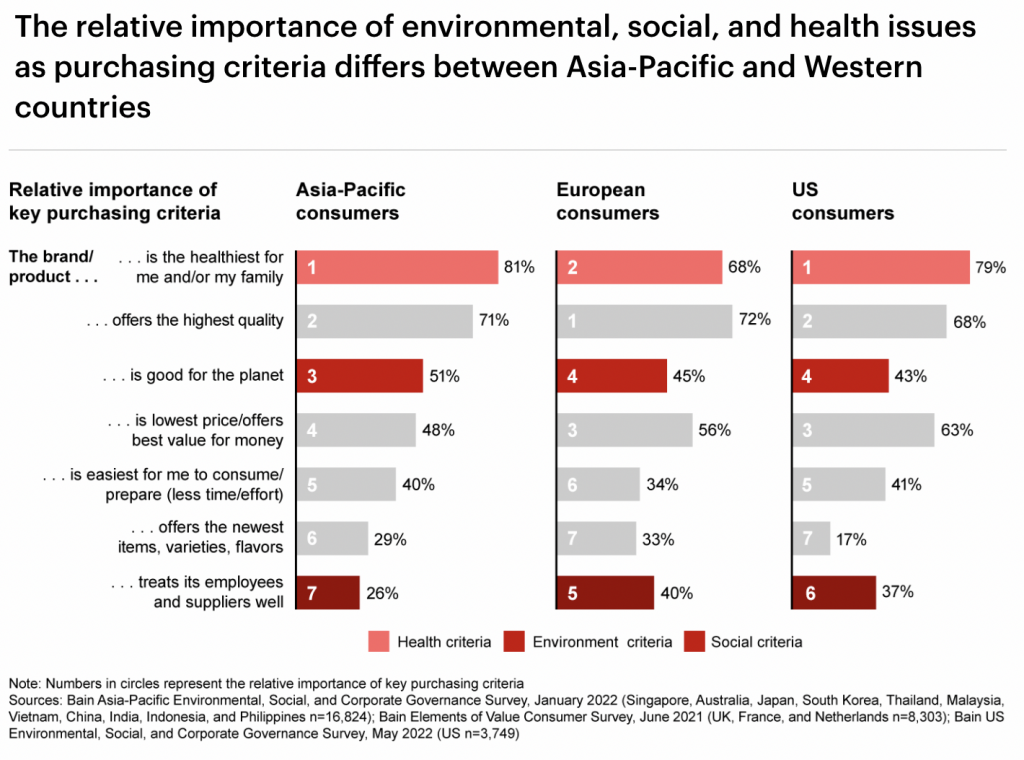

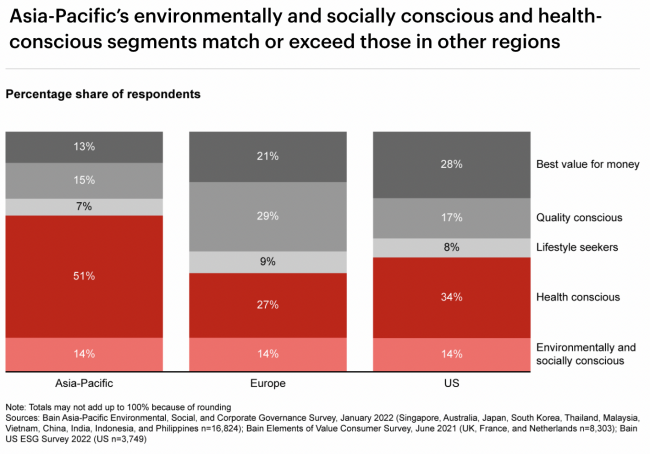

The relative importance of ESG issues as purchasing criteria differs between Asia-Pacific and western countries. 14% of all consumers across Asia-Pacific, Europe, and the US describe themselves as primarily environmentally and socially conscious. Asia-Pacific consumers rank health benefits as their top criteria (51%). 15% of Asia-Pacific consumers focus on high-quality products, compared with 29% in Europe and 27% in the US.

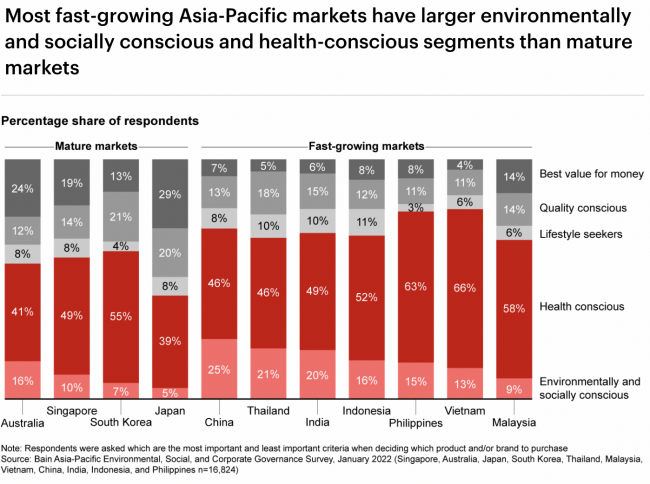

But there are also discrepancies within the region. Consumers surveyed in the region’s fast-growing markets—China, India, Indonesia, Thailand, Malaysia, the Philippines, and Vietnam—are more conscious of environmental, social, and health factors than those in the more mature markets of Australia, Singapore, Japan, and South Korea.

When asked to name the factors that motivated them to start buying sustainable products, five times more Asia-Pacific consumers cited “the personal impact of environmental issues” than mentioned “having a child”.

Interestingly, across Asia-Pacific, the percentage share of consumers identifying as both environmentally/socially conscious and health conscious was roughly the same for survey participants aged 18 to 34 years old as it was for those aged 60 years and older.

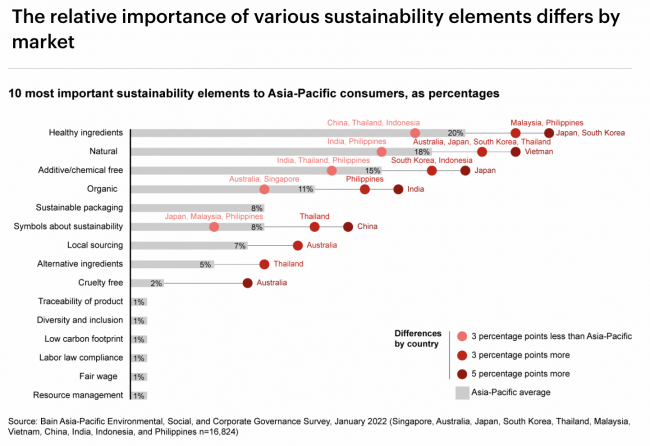

Across all 11 markets surveyed, these elements typically mattered to consumers:

- healthy ingredients

- natural

- additive/chemical free

- organic

- sustainable packaging

- sustainability symbols

- local sourcing

- alternative ingredients

- cruelty-free

The relative importance of these factors varies dramatically across local markets. For example, cruelty-free products are important to 9% of consumers in Australia compared with 2% in all 11 Asia-Pacific countries studied.

Bain & Company identifies, however, a fundamental challenge for brands—a so-called “say-do gap”. Consumers indicate they want to buy sustainable goods and are even willing to pay premium prices for them, but few actually follow through.

To narrow this gap companies might have to surmount the common challenges to shopping sustainably which are: lack of information, distrust of brand claims, lack of variety in products, and gaps in availability.

Attracting loyal advocates has the potential to accelerate the sustainability tipping point in Asia-Pacific and reward companies that seize the opportunity to learn what this booming consumer segment wants and how best to serve it.